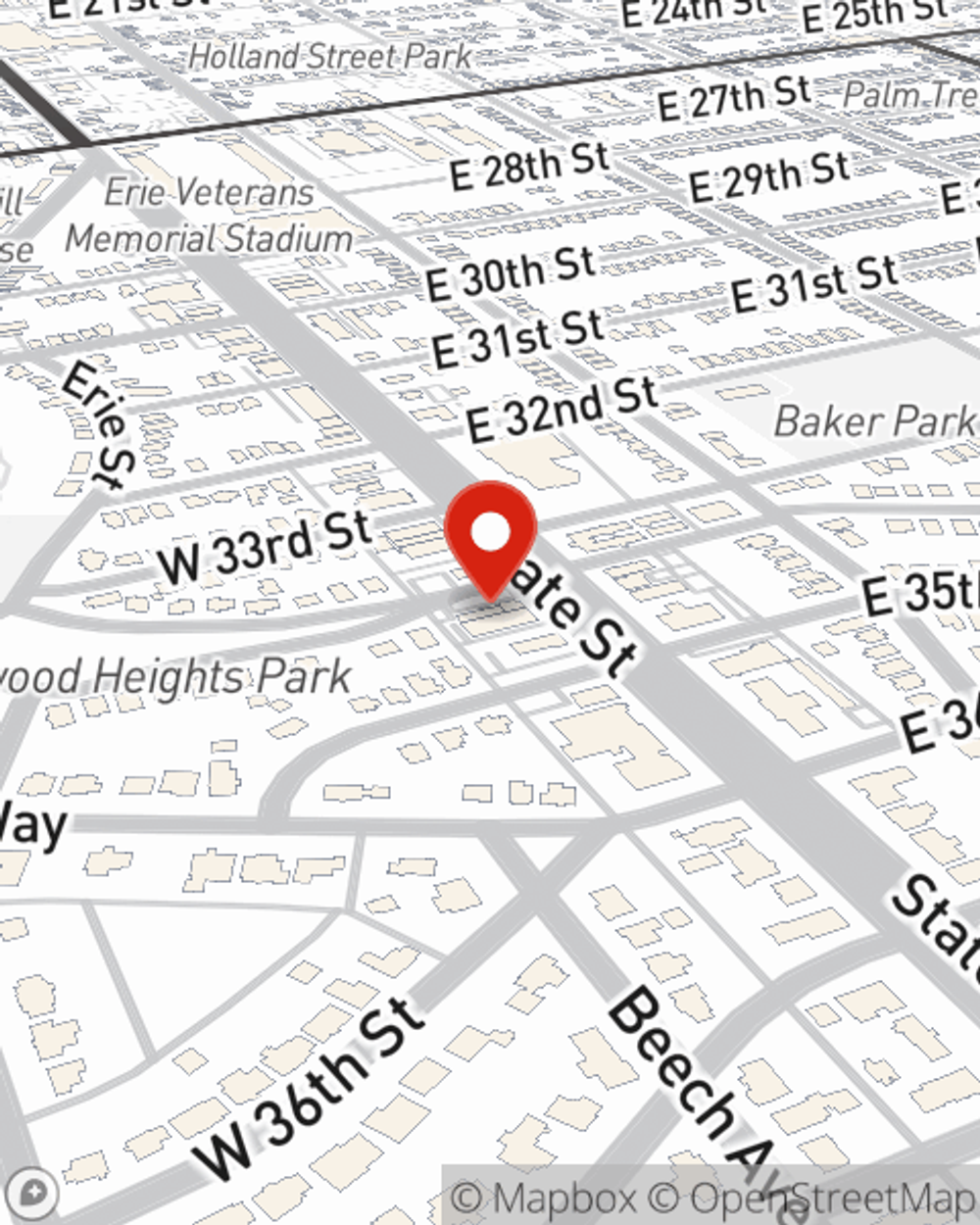

Life Insurance in and around Erie

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

If you are young and a recent college graduate, it's the perfect time to talk with State Farm Agent Jeremy Borrero about life insurance. That's because once you start building a life, you'll want to be ready if the worst happens.

Protection for those you care about

What are you waiting for?

Wondering If You're Too Young For Life Insurance?

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in terrific costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Jeremy Borrero or one of their attentive representatives. Jeremy Borrero can help design an insurance policy adjusted to fit coverage you have in mind.

If you're a person, life insurance is for you. Agent Jeremy Borrero would love to help you explore the variety of coverage options that State Farm offers and help you get a policy that works for you and your loved ones. Contact Jeremy Borrero's office to get started.

Have More Questions About Life Insurance?

Call Jeremy at (814) 455-4698 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Jeremy Borrero

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.